Aksar Sabhi Business Karne Wale Persons Ke Sath Aisa Hota Hai Ki GST ki Return Ke Liye Ya To Aap Kisi Accountant Ko Hire Karte Hai Ya Phir Kisi C.A ke pass jakar Return Ko Har Month File Karte hai? GST Ke India Me Aane Se Return File Karne Ab Kafi Easy Ho Gaya Hai. AAP Apne Ghar Baithe Aasani Se GST Ki Official Website Se GST Ki Return Ko Filed Kar Sakte Hai. Aaj main Aapko ye Batauga Ki GST Return Kya Hai? Gs Return Kaise Bharte Hai? GST Return Kaise Bhare? New GST Return File details in 2021? Tally Ke Jariye Hum GST Return Ko Aasani Se JSON File Prepare Kar Return Ko Filed Kar Sakte Hai.

GST Return Kaise Bhare 2024 | How to File GST Return Hindi 2024

GST Return Means Goods And Service Tax Ki Return, Joh Bhi Maal (Goods) Ko Hum Business Me Sale Karte hai Aur Jo Bhi Tax Hum Apne Customers Se Lete Hai Us Tax Ko Government Tak Pahuchana Aur Tax Ko Pay Karna Hi Return Kahalata Hai.

GST Me Hum 3 Types Ki Return Ko Filled Karte Hai.

- GSTR-1 (Sale Ki Return Jo Ki Quarterly/Monthly Jati Hai )

- GSTR-2(Purchase ki Return)

- GSTR-3B (Sale And Purchase Ki Summary And Tax Payment, Next Month 20 Date)

- GST Sahaj और Sugam Return क्या है? GST Return Overview हिंदी में

- जी एस टी रिटर्न फाइल कैसे करे? How to file GST Return in Hindi

- इनकम टैक्स रिटर्न फाइल कैसे करें- ITR Kaise File Kare in Hindi 2022

GSTR 3B Return Kaise Bhare? Step By Step All Procedure in 2021?

GSTR 3B Return ko Offline Bharne Ke Liye Aap Kuch Simple Steps Ko Follow Kare.Sabse Pahle GSTR 3B Offline Submit Karne Ke Liye Hame Tally Se JSON File Ko Export Karna Hoga. Just Follow these Steps carefully.

STEP:1- Sabse Pahle Aap Tally Me Sale Aur Purchase Ki Entry Ko Post Kar Le Uske Baad Aap Return Ke Menu Me jaye. Return Ke Menu Me Jane Ke Liye Ye Step Follow Kare.

Gateway Of Tally<<Display<<Statutory Report<<GST<<GSTR 3B Me Jakar Click Kare.

STEP:2- Ab Aapke Screen Par GSTR 3B Return Summary Ka Page Show Ho Jaega, Sabse Pahle Aap Incomplete And Mismatched Me Jaye Aur Check Kare ki Koi Entry Waha Incomplete Or Mismatched To Nahi Hai, Agar koi Entry ho To Use Sahi Kare Mismatched Problem Ko.

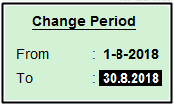

STEP:3- Ab Aapko Period Select Karna Hoga Ki Aap Kab Se Kab Tak Ki Return File Karna Chahate Hai. Just Because Hum GSTR 3B File kar Rahe Hai To 1 Month Period Hi Select Kare. (F2) Button Press Karke Period Ko Select Kare.

STEP:4- Aapko Aapki Screen Par Ab Taxable Value, Tax Etc Show Hogi, Jis Month Ke Period Ko Aapne Select Kiya Hoga, Aapko Is Data Ko Ab Export Karna Hai. Export Karne Ke Liye Aap Right Side Me Export Return Par Jakar Click kare Ya Phir Keyboard Se (Ctrl +E) Press Kare.

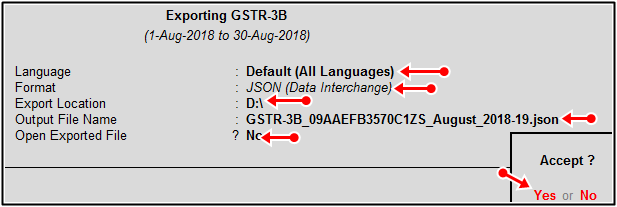

STEP:5- Aapke Samane Ab Export Retuen Ki Menu Open Ho Jaegi, Yaha Aapko Kuch Setting Karni Hai Follow It.

- Language:- Language Me Default All Language Ko Select Karege.

- Format:- Yaha Aapko Bahut Sare File Formats Show Hoge Unme Se Aap JSON(Data Interchange) Ko Select Karege.

- Export Location:- Aapko Location Select Karni Hai Jaha Aap Is JSON File Ko Save Karna Chahate Hai, Wo Location Ko Select karege.

- Output File Name:- Automatic GSTR 3b Ke Naam Se File Name Create Ho Jaega Agar Aapko File Name Ko Change Karna Hai Toh Aap Apni Marji Ke According File Name Ko Change Bhi Kar Sakte Hai.

- Open Export File:- Aap Is Option Ko Firhaal No Hi Rakhe.

Sabhi Details Ko Fillup Kar Lene Ke Baad Yes Ke Option Par Click Kare, Aapki File Export Ho Chuki Hai. Ab Aap Jis Bhi Location Me File Save Kiye The, Waha Jaye Aapko Aapki Export Ki Hui JSON File Show Ho Jaegi.

GST Return Kaise Bhare in Hindi All Procedure:-

GST Portal Me Login Kare:-

Tally Se JSON File Ko Create Kar Lene Ke Baad Aapko Ab GST Ki Official Website Par Jana Hoga Aur Apna Username And Password Fillup Karke Login Karna Hoag. Click Here GST Website:-Gst Portal Login

GST Website Se Return Filed Karne Ke Liye Kuch Steps Hai Unko Follow kare.

STEP:1- Sabse Pahle GST ki Website Par jaye Aur Login Par Click kare. Usko Baad Apna User Name, Password Aur Captcha Code Fill Karke Simply Login Ke Option par Click kare.

STEP:2-Aapke Samne Dashboard Open Ho Jaega Jaha Par Aapka Naam, Aapka GSTIN Number Wagara Show Ho raha Hoga, Aap Simply Retuen Dashboard Par Jakar Click kare.

STEP:3- Aapko Ab Apna Return Period Aur Financial Year Ko Select karna Hoga.Aap Apna Financial Year Ko Select kare Aur Kis Month Ka Return Filed Karna Hai, Woh Month Ko Select Kare Aur Simply Search Ke Button Par Click kare.

STEP:4-Aapke Samne Ab Monthly Return GSTR 3B Ka Option Show Hoga, Aap Prepare Offline Ke Option Par Jakar Click kare Aur Jo Humne JSON File Tally Se Export Ki Hui Thi Us JSON File Ko Yaha Upload Kare.

Jaise Hi Aap JSON File Ko Upload Karege, Waise Turant Aapki Sabhi Details Sale/ Purchase ki Automatic GST Portal Par Upload Ho Jaegi.Aur Monthly Return GSTR 3B Me Submitted Show Karne Lagega.

STEP:5- JSON File Upload Karne Ke Baad Again Dashboard me Aaye Again Financial Year Aur Return Period Ko Select kare Aur Monthly Return GSTR 3B Par Aakar Click Kare.

STEP:6- Aapki Screen Par Filling GSTR 3B is Now Made More User-Friendly Ka Page Show Hoga Jaha Aapko Kafi Sare Instructions Show Hoge Aap Inko Padh Sakte Hai. Aap Scroll Karke Niche Ok Ke Button Par Click Kare.

STEP:7- Yaha Aapko Kuch Question Show Hoge Jinko Aapko (Yes/No) Me Check Karna Hoga, Aaiye Discuss Karte Hai.

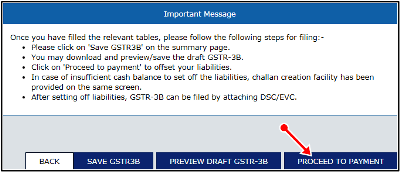

STEP:8-Ab Aapke Screen Par Tax On Output And Reverse Charge Me Aapko Aapka Tax Ki Details Show Ho Jaegi, Aap Apni Sabhi Details Ko Ek Bar Check Kar Le Aur finally Scroll Down Kare Aapko Niche Side Me Proceed To Payment Ka Option Show Hoga.

Payment Karne Ke Liye Proceed To Payment Ke Option Par Click Kare. Aap Yaha par Save GSTR 3b Me Apne Details Ko Save Bhi Kar Sakte Hai Aur Preview Draft GSTR 3B Me Preview Bhi Dakh Sakte Hai.

STEP:9- Aap Proceed To Payment Ke Option Me Jakar Jab Payment karege To Aapko Kuch Options Show Hoge, Agar Aapke Ledger Me Pahle Se balance Hoga To Hi Aap Payment Kar Paege. Agar Aapke Ledger me Balance Nahi Hoga, To Aapko Ledger me Balance Add karna PadegaMeans Electronic Cash ledger Ko Credity Karna Hoga.

Ledger me Balance Add Karna Ke Liye Aap Make Payment/Post Credit To Ledger Ke Option me jakar Balance Add Kar le, Iske Liye Aapko Kai Sare Methods provide Kiye Jate Hai Like: E- Payment, Over The Counter Aur NEFT/RTGS Etc.

Aap Kisi Bhi Mode Se Apne Electronic Cash Ledger Ko Credit Kar Sakte Hai. Aap Apne Ledger Ko Credit Kar Le Net Banking Ke Through Then Uske Baad Aapke Electronic Cash Ledger me Balance credit Ho Jaega, To Aap GSTR 3b Ki Tax Payment Kar Sakte Hai.

STEP:10- Ab Aap Again Make Payment/Post Credit To Ledger ke Option Me jayege Aur Payment karege, Then Aapke Samne Ek Message Popup Hoga Warning Ka Use Yes Kar Dege Toh OffSet Successful Ho Jaega Means Payment Successfully Ho Jaegi.

STEP:11- Aapki Screen Par Ab Process To File Ka Option Show Hoga, Aur Aapko I/We Hereby And Authorised Signature Ka Option Par Check Karke Apna name Select Karna Hoga Then Finally File GSTR 3 B With EVC Option Par Click Karna Hoga.

Jaise Hi Aap File GSTR 3 B With EVC Par Click Karege Aapke Number Par Ek OTP Message Aaega Aapko Us OTP Message Ko Verify karna Hoga, Jaise Hi OTP Verift Hoga Aapka GSTR 3B Return Filling Successfull ka Message Show Ho Jaega, Aur Aapke Mobile Number Par GSTR 3B Retuen Filled Ka Message Bhi Aa jaega.

Toh Is Procedure Ke Jariye Aap Aasani Se Apne Ghar Baithe GSTR 3B Return Ko Aasani Se Filled kar Sakte Hai.

GST Return Hindi Book Pdf Download

Adobe Photoshop Book Pdf in Hindi

GST Hindi Book Download करे

Technical Cube Tally Hindi Notes free Download

इन सभी आर्टिक्ल को पढ़े:-

- Tally सीखकर 30000 Rs Earn कैसे करे? हिंदी जानकारी

- Tally सीखकर Accountant कैसे बने? हिंदी में पूरी जानकारी।

- Tally Notes in Hindi Pdf कैसे download करे?

- Cost and Management Accounting Hindi Notes Pdf

- GST Practitioner कैसे बने? पूरी जानकारी हिंदी में जाने

- GST State Code List PDF Download

- Buy Hitech GST Billing Software with Discount

- GST offline tool क्या है? GST offline tool Download कैसे करे?

About The Post:-

Aaj Ki Is Post me Maine Aapko Bataya Ki Gst Return Kya Hai? GST Return Kaise Bhare? GSTR 3B offline? Gst Return Kaise Bharte Hai?

Gst Return Se Related Sabhi Knowledge Ko Maine Aaj Aapke Sath Share Kiya.Sath Hi Sath Maine Aapko Ye Bhi Bataya Ki Tally Ke Jariye Aap JSON File Generate Karke Kis Tarah GSTR 3B Return Ko Offline Submit Kar Sakte Hai.

Agar Aapko Ye Post Achi Lagi, Toh Isko Social Media Par jarur Share kare. Tally, Busy Accounting Software Se related Agar Aapko Koi Bhi Problem Ho To Aap Mujhe Email Kar Sakte Hai, Mai Jaldi Hi Aapko Reply Dene Ki Puri Kosis karuga.

Kis goods aur service pe kitna gst lagta hai

Bhot achha bataya hai apne par sir sabhi ko telly nahi ati hai fir kya krna chahiye

sir aapka post bahut bahut accha lga thank you sir

Thanks bro..

THANKS SIR INFORMATION KE LIYE

Thanks

Thank You so much for the tutoring ,

Maine Abhi new GSTIN liya hai, Lekin mere pass tally nahi hai or na hi mujhe aati hai, Bina tally ke Kaise GST return Kare.