Kya Aap Tally ERP 9 Software ka Use Karte Hai, Aur Ye Janana Chahate Hai Ki Tally Me Hum Different-2 Items Par GST Tax Rate Kaise Setup Kare, To Aaj ye Article Jarur Read kare. Hamare Business Me Har Ek Item Par Alag-2 Tax Rate Lagta Hai, Aise Me Hum Kis Tarah Se Tally Me GST Rate Setup kaise kare?, Isko Bare Me Aaj Mai Aapko Puri Jankari Duga.

Tally Me GST Kaise Setup Kare? How to setup GST Rate in Tally?

Tally Me GST Rate Ko Kaise Setup Kare, Usko Liye Aapko Pahle Company Me GST Ko Enable Karna Hoga, Aaiye Janate Hai tally Me GST Ko Setup Kaise kare.

Aaiye Janate Hai Ki GST Me Tax Kitne Type Lagta Hai.

- 0% Tax___Nil Rated

- 5% Tax___Isme 2.5 CGST And 2.5 SGST

- 12% Tax___ Isme 6% CGST And 6% SGST

- 18% Tax___Isme 9% CGST And 9% SGST

- 28% Tax___Isme 14% CGST And 14% SGST

STEP:1 Sabse Pahle Tally Me Company Ko Open Kare, Aur Gateway Of Tally me Features (F11) Option me Jaye, Ya Phir Apne Keyboard Se F11 Press Kare Aapke Screen Par Features Options Dhow Ho Jaega.

STEP:2- Ab Aapko Statutory And Taxation Me Jakar Click Kare.

STEP:3- Statutory and Taxation Me Aapko Enable Goods And Service Tax(GST) Ko Aapko Yes Karna Hai, Aur Set/Alter GST Details Ko Bhi Yes Kare.

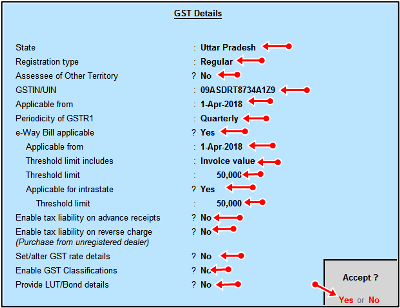

STEP:4- Set/Alter GST Details Ko Yes karne par Aap Ke Samne Kuch GST Details Show Hogi, Is Details Fillup karna Hai.

- State:- Aapne State Ko Select kare.

- Registration Type:- Registration Type Me Regular Ya Composition Dealer Aap Jo Ho Usko Select Kare.

- Accessed Of Other Territory:- Yaha Aapko No Hi Rakhna Hai.

- GSTIN/UIN:- Yaha Aap Apni Company/ Firm ka GSTIN No Ko Fill kare.

- Applicable From:- Jis Bhi Date Se Applicable Hai, Wo Date Fillup Kare.

- Periodicity Of GSTR-1:- Aap GSTR 1 Kab Filing Karte Hai, Monthly ya Quarterly Use Select Kare.

- e-way Bill Applicable:- Kya Aap E way Bill Ko Generate Karna Chahte Hai, To Yes kare.

- Applicable From- Jab Se eWay Bill Applicable Hua Hai, Wo Date Fillup Kare.

- Threshold Limit Includes:- Isme Aapko Invoice Value Ko Hi Rahne Dena Hai.

- Threshold Limit:- Isme Aap E way Bill ki Kya Limit hai, Jo Ki 50000 Hai use Hi Rakhe.

- Applicable For Interstate:- Isme Aap Agar Interstate Dealer hai To Yes Kare.

- Threshold Limit:- Threshold Limit Jo Bhi Ho Usko Setup Kare.

- Enable Tax Liability Of Advance Receipt:- Is Option Ko No hi Rakhe Kyuki Ye tab Yes Karege Jab Tax Liability of Advance Receipt Hogi.

- Enable Tax Liability Of Reverse Charge:- Isko No Hi rakhe Because of Reverse Charge Ke Liye Aap Applicable Ho To Hi Yes kare.

- Set/Alter GST Rate Details:- Aap Apni Company/Firm Me GST Tax Rate Ko yaha Se Bhi Set kar Sakte Hai, But jab Aap Ek Hi Tax Rate Ki Item Ka Business kar rahe Ho Toh, Isko Yes kare Warna No Hi Rakhe.

- Enable GST Classification: Is Option Ko No Hi Rakhe.

- Provide LUT Bond Details:- Isko Aap No Hi rakhe.

Sari Details Ko Fillup Karne Ke Baad Aap isko Save Kar Le.

STEP:5- Sari GST Details Ko Fillup karne Ke Baad Simple Yes karke Details Ko Save Kar Le.

Ab Aapki Company Me Successfully GST Enable Ho Chuka Hai. Read More Articles:- GST offline tool क्या है? GST offline tool Download कैसे करे?

Tally Me GST Rate Setup Methods:-

Tally Me GST Rate Setup Karne Ke 4 Basic Methods Hai.

- Company Me GST Tax Rate Setup Kar Sakte Hai.

- Stock Groups Me GST Tax Rate Setup Kar Sakte Hai.

- Stock Items Me GST Tax Rate Setup Kar Sakte Hai.

- Ledgers Me GST Tax Rate Setup Kar Sakte Hai.

GST Setup in Tally ERP 9.

Tally Me GST Tax Rate Ko Setup Karne Ke Liye Kuch Simple Kuch Steps Ko Follow kare.

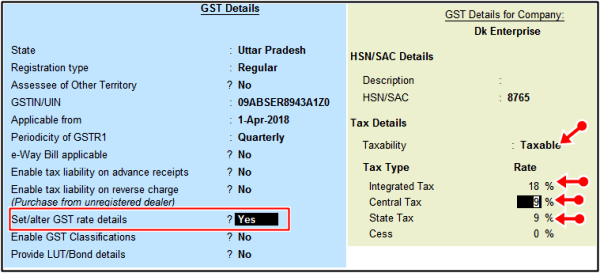

1- Company Me GST Tax Rate Setup:-

Aap Company Me Jab GST Enable Karte hai To Aap GST Tax Rate Ko Aasani Se Setup kar Sakte Hai, But Is me Ek Condition Ye hai Ki Agar Aap only Ek Hi Type Ke Tax Rate Me Apna Business Karte Hai To Hi Aap Company Me GST Tax Rate Ko Setup kare.

Example:- Agar Aap Only 12 % Wale GST Tax Rate Me Business Karte hai To Hi Aap Isko Enable Kare, Agar Aap Ek Se Jada Tax Rate Me Business Karte hai To Aap GST Tax Rate Company Me Na Setup Kare.

Company GST Rate Setup Aise Kare Follow The Screenshot:-

Aap GST Details Me Set/Alter Gst Details Ke Option Me Jakar Yes Kare. Ab Aapke Samne GST Details For Company ka Page Open Hoga. Yaha Kuch Details Ko Fillup kare.

- Description:- Description Ko Fill Kare.

- HSN/SAC:- HSN/SAC Details ko Fillup Kare.

- Taxability:- Taxability Me Taxable Select Kare.

- Integrated Tax:- Jo Bhi Tax rate Ho Wo Fill Kare.

- Central Tax:- Automatic Calculate kar Lege, Jab Integrated Tax Fill karege.

- State Tax:– Automatic Calculate kar Lege, Jab Integrated Tax Fill karege.

- Cess:- Agar Cess Charge Ho To Wo Bhi Fill Kare.

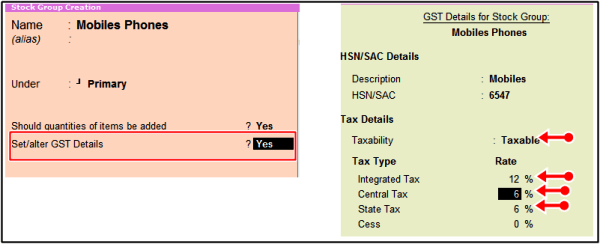

2- Stock Groups Me GST Tax Rate Setup:-

Aap Stock Groups me Jakar Tax Rate Ko Set Kar Sakte Hai Ki Is Stock Groups Me Itne Percent Tax Lagaega, Suppose Ek Stock Groups Me Kafi Sari Items Hai Ab Agar Aap Stock Group Me Hi Tax Rate Setup Kar Dege To Un Sabhi Items Par Wo Tax Rate Apply Hoga.

Stock Groups GST Rate Setup Aise Kare Follow The Screenshot:-

Stock Group Me jakar Set/Alter GST Details Ko Yes kare, Aur GST Details For Stock Groups Me GST Tax rate Jo Bhi Ho Usko Fill kare.

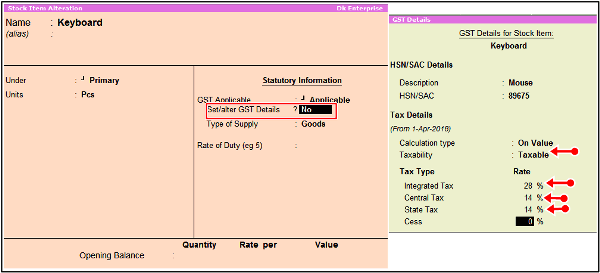

3- Stock Items Me GST Tax Rate Setup:-

Tally Me Aap Stock items par Alag-2 Tax Rate Ko Bahut Hi Aasani Se GST Tax rate Set Kar Sakte Hai. Aap Jo Bhi Stock Items Create Kare, Usme Aap GST Tax Ko Set Kar Sakte Hai.

Stock Items GST Rate Setup Aise Kare Follow The Screenshot:-

Stock Items Me Jaye Aur Set/Alter GST Details Ko Yes kare, Aur GST Details For Stock Items Me GST Tax rate Jo Bhi Us Stock Item par Ho Usko Fill kare.

Read It:-

- Tally Me GST Bill Kaise Banaye?

- Tally में Medical का काम कैसे करे? Medical Store Accounting

- Tally Me Data Export Kaise Kare-

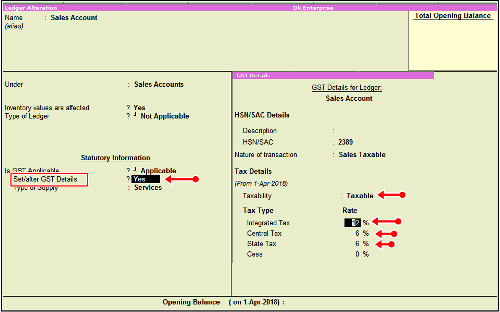

4- Ledgers Me GST Tax Rate Setup:-

Jab Bhi Aap Tally Me Ledgers Ko Create Karte hai Aap Us Ledger Me Bhi GST Tax rate Ko Setup Kar Sakte Hai.

Stock Items GST Rate Setup Aise Kare Follow The Screenshot:-

Ledger Create Karte Time Niche Aapko Set/Alter GST Details Ka Option Show Hoga, Usko Yes kare, Aur GST Details For Ledgers Me GST Tax rate Jo Bhi Ho Usko Fill karke Save kar Le.

So In Procedures, ko Follow Karke Aap Aasani se GST Tax Rate Ko Tally Me Setup Kar Sakte Hai. Aap Stock Items, Stock Groups, Company, And Ledgers Me Tax Rate Ko Set Kar Sakte Hai, Jaisi Aapki Requirement Ho Aap Usi Ke According GST Tax Rate Ko Set Up Kare.

Tally Study Materials Download PDF:-

Tally ERP 9 Ke Notes, Syllabus, Inventory Notes, Shortcut keys PDF Me Download Karne Ke Liye Link Par Click Karke Download Kare.

आज के इस आर्टिक्ल मे मैंने आपको ये बताया की Tally Me GST Tax rate Setup कैसे करे? GST Tax Rate Setup Karne Ke Kya Methods होते है, इसकी पूरी जानकारी आज मैंने आपको दी।

मैं उम्मीद करता हु की ये आर्टिक्ल आपको पसंद आया होगा, अगर आपको ये आर्टिक्ल पसंद आया तो इसको सोश्ल मीडिया पर अपने दोस्तो के साथ जरूर से शेयर कीजिए, जिस से उनको भी ये जानकारी प्राप्त हो सके।

achi information hia tally me gst rate ki

Thanks…

Thanks for sharing such a good information.

GST Suvidha Center or GST service center is the ultimate destination to resolve all your problems related to GST.

Thanks for sharing such a good information.

Apply for udyam registration online via official portal