Aaj mai Aapko Basic Accounting Entry Jo Ki Tally Me Hum Post Karte Hai, Uske Bare Me Batauga. Tally Ko Seekhne Ke Liye Aapko Pahle Basic Entry Jo Hum Tally Me Karte Hai, Unko Seekhna kafi jaruri Hai, Kyuki Jab Tak Aap Basic Entry Ko Nahi janege Tab Tak Aap Tally Me Entry Ko nahi kar Sakege. Basic Accounting Entries Tally? To Aaiye Janate Hai.

Basic Accounting Entries in Tally Hindi 2023? full details

Basic Accounting Entry Ki Agar Hum Baat Kare To Mai Aapko Ye Batana Chahauga Ki Tally Me Entry Post Karne Ke Liye Hame Alag-2 voucher Tally ERP 9 Software Me Milte Hai, Jinki Help Se Hum Tally me Entry Karte Hai, Har Ek Voucher ka Tally Me Alag Nature Define Kiya Gaya hai,

Jiski Wajah Se Hum Unhi vouchers Me entry Post Karte Hai, Jo Unse Related Hota Hai Like- Payment Agar Aap Kisi Ko Kar Rahe Hai Toh Uski Entry Hum payment Voucher me Karege.

Aaiye Janate Hai Ki Basic Accounting Entries Tally Me Karne Ke Liye Kaun-2 Se Voucher Hai Tally Softwares Me.

- Busy Accounting Software Kya Hai?

- Busy Me GST Bill Kaise Banaye?

- Tally Me Payroll Kya Hai? Jankari In Hindi

Accounting Voucher Kya Hai? आइये जाने

Accounting Voucher ka Matlab Un Vouchers Se Hai, Jo Accounts Ki Basic Transaction Ko Store Karne Ke Liye Karte Hai.

Types Of Accounting Vouchers:-

1.Contra Vouchers

2.Payment Voucher

3.Receipt Voucher

4.Journal Voucher

5.Sale Voucher

6.Purchase Voucher

1.Contra Vouchers: Contra Voucher Ka Use Hum Tab Karte Hai, Agar Humko Bank Me ( Cheque Ya Cash Deposit) Karte Hai To, Ya Phir Bank Se paise Nekalte hai Ya To Transfer Karte Hai, Ek Bank Se Dusare Bank Me To Contra Voucher Ka Use Karte Hai.

4 Types Of Transaction in Contra Vouchers.

A. Cash Deposit in Bank.

B. Cash Withdrawn From Bank.

C. Loan from Bank.

D.Loan Repayment From Bank.

Contra Voucher Me Hum 3 Types Ki Transaction Ki Entry Karte Hai.

- Bank To Bank Transaction

- Bank To Cash Transaction

- Cash To Bank Transaction

Bank To Bank Transaction Entry

Bank To Bank Transaction Entry Me Hum Ek Bank Se Duasre Bank Me Paise Transfer Kar Sakte Hai, Uske Liye Hu IDBI Bank Ko Credit Karege Aur SBI Bank Ko Debit Karege.

Bank To Cash Transaction Entry

Bank To Cash Transaction Entry Me Hum Bank Se Cash Withdrawl Kar Sakte Hai.

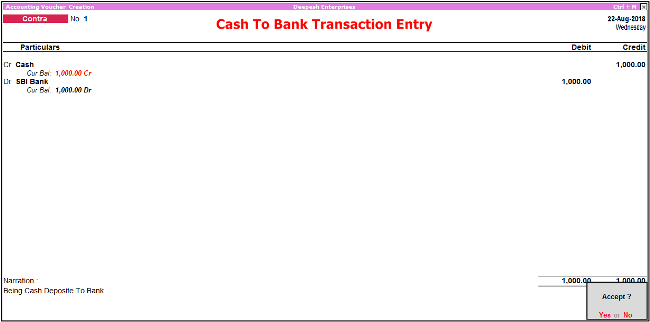

Cash To Bank Transaction Entry

Cash To Bank Transaction Entry Me Hum Cash Ko Deposite Kar Sakte Hai Bank Me

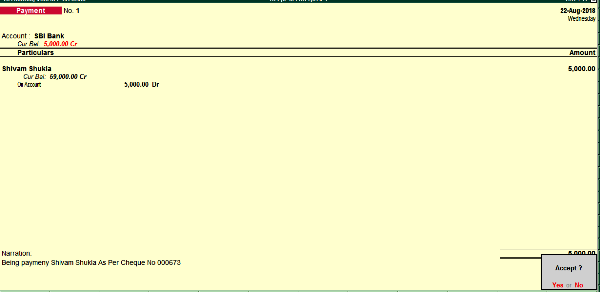

2-Payment Voucher:-

Jab Bhi Hum (Cash Or Cheque) Se Kisi ko Payment Karte hai, Means Business Se Paisa Bahar Ja Raha ho, Phir Wo Kisi Bhi Tarah Se Jaye.

Payment Voucher Me Entry Aise Kare.

Payment Voucher Me Entry Karne Ke Liye Aapko Sabse Pahle Account Ka Option Dikhai Dega. Account Ke Option Me Apko Apna Bank Select Karna Hai, Jis Bhi Bank Se Aap Payment Kar Rahe Ho, Usko Select Kare, Phir Niche Aae Particulars Me yaha Par Aapko Jis Bhi (Party, Ya Person) Ko Payment Deni Hai, Uska Ledger Select Kare Aur Jitni Bhi Payment Deni Hai Woh Amount Fill Karke Simple Entry Ko Post Kar Sakte Hai.

3- Receipt Voucher:-

Receipt Ka Matlab Hota Hai, Paisa Aana Business Me. Jab Bhi Hamare Business Me Paisa Kahi Se Aata Hai, Means Amount Receipt Jab Hota Hai, To Uski Entry Hum Receipt Voucher Me Karte Hai. Example:- Interest Receipt Kar Rahe Ho To Receipt Voucher ka Use Karte Hai.

Receipt Voucher Me Entry Aise Kare.

Receipt Voucher Me Entry Karne Ke Liye Aapko Sabse Pahle Account Ka Option Dikhai Dega. Account Ke Option Me Apko Apna Bank Select Karna Hai, Phir Niche Aae Particulars Me Yaha Par Aapko Jis Bhi (Party, Cash, Online Transaction Ya Kisi Person) Se Payment Received Hui Hai, Uska Ledger Select Kare Aur Jitni Bhi Payment Aai Hai Woh Amount Fill Karke Simple Entry Ko Post Kar Sakte Hai.

4- Sale Voucher:-

Sale Voucher Me Aapko Keval Ek Entry Karni Hoti Hai, Maal(goods) Udhar Bechane Par Means (Goods Sold On Credit).

Sale Voucher Me Entry Karne Ke Liye Aapko Kuch Simple Steps Ko follow karne Padege.

(1) Sale No 1:- Ye Number Automatic Aapke Sale Bill Me Show Hoga.

(2) Date:- Aapko Jis Bhi Date ka Bill Create Karna Ho Aap Us Date Ko Fillup Kare. But Aap Education Mode Ko Use Kar Rahe Hai, Toh Mai Bata Du Ki Aap Education Mode Me Only 1 Ya 2 Date Ki Hi Entry Ko Post Kar Paege Aur Others Dates Ki Entry Karne Ke Liye Aapko Tally Ka Silver Ya Gold Version Purchase Karna Padega. Mera Tally Ka License Version Hai, Isliye Mai Yaha Par 10 Tarikh Ki Entry Post Kiya Hu Jaisa Ki Aap Screenshot Me Dakh Pa Rahe Hai.

(3) Reference No:- Reference No Ko Hi Hum Bill No Bhi Kahte Hai, Aapko Yaha Par Apne Bill Ka Ek No Fill Karna Hai, Phir Wo Chahe Kuch Bhi Ho Sakte Hai. Example (GST/01/18-19) Log Aisa Kuch Unique Bill No Create Karte Hai.

(4) Party A/c Name:- Party A/c Name Me Aapko Jis Bhi (Party/ Customer) Jis Ko Goods Sale Karna Hai, Uska Naam Fill Karege. Naam Fillup Karne Ke Liye Aapko Us Party Ka Ledger Create Karna Hoga. Ledgers Create Karne Ke Liye Is Post Ko Read Kare.

Tally Me Bill Create Karte Waqt Agar Ledger Create Karna Ho To Us Ke Liye Aapko Apne Keyboard Se (Alt+C) press Karna Hoga. Alt+C Press Karte Hi Aapko Samne Ledger Creation Ka page Open Ho Jaega. Ledger Create Karne Ke Liye Kuch Required Fields Ko fillup, Kare Jo Ki Kuch Is Tarah Se Hai.

(5) Sales Ledger:- Ab Aapko Ek Sale ka Ledger Create Karna Hoga. Aap Is Tarah Se Sales ka Ledger Create Kar Sakte Hai. Follow The Screenshot.

(6) Item:- Ab Aapko Jo Bhi Items Sale karna Hai Usko Aapko Create karna Hoga. Jaisa ki Maine Apni Pichli Post Me Bataya Tha Ki Tally Me Stock Items Ko Kaise Create Kare Aap Uske Liye Is Post Ko Read Kar Sakte Hai.

Tally Me Bill Banate Waqt Stock Items ko Creat Karne Ke Liye Keyboard Se (ALT+C) Press Kare. Alt+C Press karne Ke Baad Aapke Samne Stock Creation Ka Page Aa jaega. Ab Aapko Jo Bhi Stock Create Karna Hai, Uski Sari Details ko Yaha Fill Up Kare.

Yaha Par Maine Fridge Naam Ka Ek Stock Item Ko Create Kiya Hai, Aaiye jante Hai Ki Stock Item Ko Kaise Create Kare Aur Tax Rate kaise Setup Kare?

- Name:- Name Me Aapko Jo Bhi Stock Item Create Karna Hai Uska Pura Naam Fillup Kare.

- Under:- Under Me Isko Primary Me Hi Rakhe.

- Units:- Stock Item Ke Liye Ek Unit PCS Create Kar Le. Unit Create Karne Ke Liye Keyboard Se (Alt+C) Press Kare Aur Units Ko Create Kar Le. Kuch Is Tarah Se Jaisa Screenshot Me, Maine Ki Hai.

- GST Applicable:- Yaha Aapko Ye Batana Hai Ki Aap GST Applicable Karna Chahate Hai Ki Nahi, Aapko Simply Applicable Option Par Click Karna Hai.

- Set/Alter GST Details:- Set/ Alter GST Details Ko Yes karna Hai, Aap Jaise Hi Isko Yes Karege Aapke Samne Aisa Page Open Hoga, Jisme Aapko Stock Item Se Related Sari Details jaise Description, HSN/SAC Code, Tax Details Aur Tax Type Ko Fillup Karna Hoga. Screenshort Me Aap Dakh Sakte Hai.

- Type Of Supply:- Types of Supply Me Aapko Goods Ko Select Karna Hai.

Sari Details Fillup Karne Ke Baad Simply Yes Ke Option Par Click Karke Ledger Ko Save Kar Lege.

Item Create Karne Ke Baad Aapko Us Item Ki Kitni Quantity Ko Sale Karna Hai, Kis Rate Me Sale Karna Hai Wo Sari Details Ko Fillup Karna Hoga.

(7) Isi Tarah Ek Aap A.c Naam Ka Ek Item Aur Bhi Create kar Lege, Jaise Maine Aapko Upar Bataya hai.

(8) CGST:- Ab Aapko Tax Ke Ledgers Ko Create Karna Padega, Hamari Party Local Hai Isliye Hum CGST, SGST Ka Ledgers Ko Create Karege. CGST Means (Central Goods And Service Tax) Aur SGST (State Goods And Service Tax). CGST Ka Ledger Create Karne Ke Liye Screenshot Dakhe.

(9) SGST:- SGST Ka Ledger Create Karne Ke Liye Is Screenshot Ko Follow Kare. I Hope Ki Ab Aapko Ledger Create Karne Me Koi Problem Nahi Ho Rahi Hogi.

Jaise Hi Aap Tax Ledgers Save Karke, Ledgers Ko Enter Karege, Aapke Bill Me CGST Aur SGST Tax Automatic Show Ho Jaege.

(10) Provide GST/Eway Bill Details: Isko Aapko No Hi Karna Hai, Ye Option Ko Yes Tabhi Karege Jab Aapke Invoice Ki Value 50000 Ya 50000 Se Jada Hogi.

(11) Narration:- Future Me Aapko Yaad Na Rahe Ki Kis Bill Me Kya Entry Post Ki Hui Thi, Uske Liye Hu Ek Short Narration Likh Dete Hai, Jis Se Hamko Yaad Rahe. Jaise Maine Credit Par Rohan Ko Goods Sale Kiya To Mai Ek Short Narration Likh Duga Ki- Being Goods Sold On Credit As Per Bill No 123.

Ab Sale Voucher Ko Yes Karke Entry Ko Save Kar Lege.

5- Purchase Voucher:-

Aap jab Kisi Tarah Ki Kharedari Karte Hai Tally Me To Uski Entry purchase Voucher Me Karte Hai. Generally Purchase Hum Log Udhari Me Karte Hai, Yani Credit Me Karte Hai. Tally Hame Dono Tarah Ki Entry Karne Ki Facility Provide Karta Hai, Fir Chahe Cash Me Purchase Ho, Ya Phir Credit Me Purchase Ho.

Purchase Voucher Ki Entry Karne Ke Liye Kuch Simple Steps Ko follow Karne Padege.

(1) Purchase No 1:- Ye Number Automatic Aapke Purchase Bill Me Show Hoga.

(2) Date:- Aapko Jis Bhi Date ka Bill Create Karna Ho Aap Us Date Ko Fillup Kare. But Aap Education Mode Ko Use Kar Rahe Hai, Toh Mai Bata Du Ki Aap Education Mode Me Only 1 Ya 2 Date Ki Hi Entry Ko Post Kar Paege Aur Others Dates Ki Entry Karne Ke Liye Aapko Tally Ka (Silver Ya Gold Version) Purchase Karna Padega. Mera Tally Ka License Version Hai, Isliye Mai Yaha Par 22 Aug 2018 Tarikh Ki Entry Post Kiya Hu, Jaisa Ki Aap Screenshot Me Dakh Pa Rahe Hai.

(3) Supplier Invoice No:- Supplier Invoice No Ko Hi Hum Bill No Bhi Kahte Hai, Aapko Yaha Par Apne Supplier Ke Bill Ka No Fill Karna Hai, Jo Bill Aapko Aapke Supplier Ne Diya Hai Phir Wo Chahe Kuch Bhi Ho Sakte Hai. Example (GST/01/18-19) Log Aisa Kuch Unique Bill No Create Karte Hai.

(4) Date:- Date Me Aapko Jis Din Aapne Goods Ko Received Kiya Us Din Ki Date Ko Yaha Par Fillup Karege.

(5) Party A/c Name:- Party A/c Name Me Aapko Jis Bhi (Party/ Customer) Jis Se Goods Received Hua Hai, Uska Naam Fill Karege. Naam Fillup Karne Ke Liye Aapko Us Party Ka Ledger Create Karna Hoga. Ledgers Create Karne Ke Liye Is Post Ko Read Kare.

Tally Me Bill Create Karte Waqt Agar Ledger Create Karna Ho To Us Ke Liye Aapko Apne Keyboard Se (Alt+C) press Karna Hoga. Alt+C Press Karte Hi Aapko Samne Ledger Creation Ka page Open Ho Jaega.

(6) Purchase Ledger:- Ab Aapko Ek Purchase ka Ledger Create Karna Hoga. Aap Is Tarah Se Purchase ka Ledger Create Kar Sakte Hai.

(7) Item:- Ab Aapno Jo Bhi Items Purchase Ki Hui Hai Usko, Simply Aapko Us Item Ko Create Karna Hoga. Jaisa ki Maine Apni Pichli Post Me Bataya Tha Ki Tally Me Stock Items Ko Kaise Create Kare, Aap Uske Liye Is Post Ko Read Kar Sakte Hai.

Tally Me Stock Items Kaise Banaye?

Tally Me Bill Ki Entry Karte Waqt Stock Items ko Creat Karne Ke Liye Keyboard Se (ALT+C) Press Kare. Alt+C Press Karne Ke Baad Aapke Samne Stock Creation Ka Page Aa jaega. Ab Aapko Jo Bhi Stock Item Create Karni Hai, Uski Sari Details ko Yaha Fill Up Kare. Yaha Par Maine Honda Bike Naam Ka Ek Stock Item Ko Create Kiya Hai, Aaiye Jante Hai Ki Stock Item Ko Kaise Create Kare Aur Tax Rate Kaise Setup Kare?

- Name:- Name Me Aapko Jo Bhi Stock Item Create Karna Hai Uska Pura Naam Fillup Kare.

- Under:- Under Me Isko Primary Me Hi Rakhe.

- Units:- Stock Item Ke Liye Ek Unit PCS Create Kar Le. Unit Create Karne Ke Liye Keyboard Se (Alt+C) Press Kare Aur Units Ko Create Kar Le. Kuch Is Tarah Se Jaisa Screenshot Me, Maine Ki Hai.

- GST Applicable:- Yaha Aapko Ye Batana Hai Ki Aap GST Applicable Karna Chahate Hai Ki Nahi, Aapko Simply Applicable Option Par Click Karna Hai.

- Set/Alter GST Details:- Set/ Alter GST Details Ko Yes karna Hai, Aap Jaise Hi Isko Yes Karege Aapke Samne Aisa Page Open Hoga, Jisme Aapko Stock Item Se Related Sari Details jaise Description, HSN/SAC Code, Tax Details Aur Tax Type Ko Fillup Karna Hoga. Screenshort Me Aap Dakh Sakte Hai.

GST Details Aur Tax Rate Ko Is Tarah Setup Kare

- Description:- Isme Aap Item Ki Description Ko fill Karege

- HSN/SAC:- Item ka HSN Code Fill Karege Aur Agar Service Ki Sell Kar Rahe Hai Toh SAC Code use Karege.

- Calculation Type:- Is me On Value Select Karege.

- Taxability: Isme Aap Taxable Ko Select Karege

- Tax Type: Tax Type Me Us Item par Jo Tax Rate hai Usko Fill kare Tally Automatic CGST Aur SGST Tax Calculate Kar Lega.

- Type Of Supply:- Types of Supply Me Aapko Goods Ko Select Karna Hai.

Sari Details Fillup Karne Ke Baad Simply Yes Ke Option Par Click Karke Ledger Ko Save Kar Lege.

Item Create Karne Ke Baad Aapko Us Item Ki Kitni Quantity Ko Aapne Purchase Ki Hai, Kis Rate Me Purchase Ki Hai Wo Sari Details Ko Fillup Karna Hoga.

(8) CGST:- Ab Aapko Tax Ke Ledgers Ko Create Karna Padega, Hamari Party Local Hai Isliye Hum CGST, SGST Ka Ledgers Ko Create Karege. CGST Means (Central Goods And Service Tax) Aur SGST (State Goods And Service Tax). CGST Ka Ledger Create Karne Ke Liye Screenshot Dakhe.

(9) SGST:- SGST Ka Ledger Create Karne Ke Liye Is Screenshot Ko Follow Kare. I Hope Ki Ab Aapko Ledger Create Karne Me Koi Problem Nahi Ho Rahi Hogi, Agar Aapko Ledger Create Karne Me Koi Bhi Problems Hai, Toh Aap Meri Ledger Creation Ki Post Ko Read Kar Sakte Hai.

(10) Provide GST/Eway Bill Details: Isko Aapko No Hi Karna Hai, Ye Option Ko Yes Tabhi Karege Jab Aapke Invoice Ki Value 50000 Ya 50000 Se Jada Hogi.

(11) Narration:- Future Me Aapko Yaad Na Rahe Ki Kis Bill Me Kya Entry Post Ki Hui Thi, Uske Liye Hu Ek Short Narration Likh Dete Hai, Jis Se Hamko Yaad Rahe. Jaise Maine Credit Par Shivam Se Goods Ko Purchase Kiya To Mai Ek Short Narration Likh Duga Ki- Being Goods Purchase On Credit As Per Bill No GST/01/18-19.

Ab Yes Karke Purchase Voucher Me Entry Ko Save Kar Lege.

Tally Study Materials Download PDF:-

Tally ERP 9 Ke Notes, Syllabus, Inventory Notes, Shortcut keys PDF Me Download Karne Ke Liye Link Par Click Karke Download Kare.

- Tally Notes in Hindi Pdf

- Tally Inventory Notes Pdf

- Shortcut Keys in Tally ERP 9 PDF

- Tally Course Syllabus Pdf

- Tally Voucher Entry in Hindi Pdf

About The Post:-

Aaj Ki, Is Post Me Maine Aapko Ye Bataya Ki Aap Basic Accounting Entries in Tally? Tally Accounting Entry Kaise Kare? Tally Me Basic Accounting Entry Karna Aaj Humne Seekha. I Hope you Like This Post.

Agar Aapko Entry Karne Me Koi Bhi Problem Ho To Aap Mujhe Mail Kar Sakte Hai, Mai Jaldi Hi Aapki Problem Solve Karne Ki Puri Kosis Karuga. Tally, Busy Accounting Any Software Me agar Aapko Kisi Bhi Topic Me Problem Ho To Aap Mujhe Contact Kar Sakte Hai.

Muje detail main Tally sukhna hai

aap mujhse contact kare