Friends Aapne Busy Accounting Software Ka Name Jarur Se Suna Hoga.Aj Present Time Me Business Karne Wale Persons Busy Accounting Software Ko Jada Like Karte Hai, Kyuki Busy Ko Use Karna Behad Easy Hai.Busy Me Hum Per Day Ki Transactions, Jo Ki Hamare Business Me Hoti Hai-Like Sale, Purchase, GST Bill Banana, Payment Karna Etc, Ko Hum Busy Accounting Software Ke Jariye Hi Karte Hai. Agar Aap Kisi Small Shop Ko Chalate Hai Aur Aap GST Bill Banana Chahte Hai, To Aaj ki Ye Post Aap Logo Ke Liye Bahut Important Hai, Aaj Mai Aapko Busy में जीएसटी बिल कैसे बनाये? how to make an invoice? In Sabki Jankari Duga.

Busy में जीएसटी बिल कैसे बनाये? Create Gst Bill in Busy Accounting Software 2023

Busy Accounting Software Me GST Bill Kaise Banaye? Ye Sawal Aapke Man Me Jarur Aata Haga. Apne Business Ko Proper dang Se manage Karne Ke Liye Customers Ko GST ka Bill Dena Necessary Ho Gaya Hai.

Aise Me Busy Me GST BIll Kaise Banaye, Kis Tarah Se Goods Sale Karne par Tax Calculate Kare, Kis Goods Par Kitne Percent Tax Lagega, Bill Ko Kaise Print kare? Aaj mai Aapko GST Bill Se Related In Sabhi Sawale Ke Jawab Duga, To Aaiye jante Hai.

Busy Accounting Software Me GST Bill Banane Ke Liye Aapko Kuch Steps ko Follow Karne Padege

STEP-1: Sabse Pahle Busy Software Me Company Ko Open Kare. Open Karne Ke Liye Open Company Par Simply Click Kare

STEP:-2 Company Ko Select Karke Open Kare.

STEP:-3 Ab Apni Company Ka User Name And Password Fillup Karke Ok Ke Button Par Simply Click Kare.Aapki Company Open Ho Jaegi.

STEP-4: Uske Baad Aap Transactions Ke Option Me Jakar Sale Ke Option Par Click Karege.

STEP-5: Sale Option Me Click Karne Par Aapko 3 Menu Show Hogi.( Add, Modify And List) Aapko Simply New Bill Banane Ke Liye Add Ke Option Par Click Karna Hai.

Aaiye Jante Hai Ki Add, Modify And List Options Kya Hai??

- Add:- Jab Bhi Hamko New Bill Create karna Ho Ya New Bill Ki Entry Karni Ho, To Hum Add Option Ka Use Karte Hai.

- Modify:- Jo Bhi Bill Hum Create Kar Chuke Hai Agar Usme Koi Bhi Modification Karna Ho, Changes Karna Ho Toh Hum Modify Option ka Use karege.

- List:- Sabhi Bill’s ko Check Karne Ke Liye Hum List Option Ka Use Karte Hai Is Se Hamare Sare Bill Ek List Ke form Me Show Ho Jate Hai

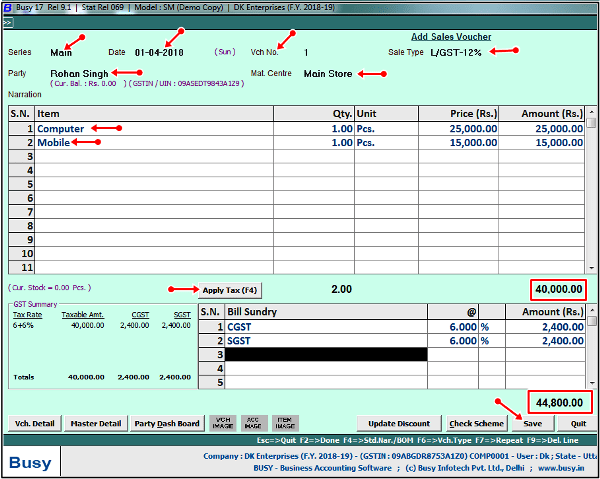

STEP-6: Ab Aapko Bill Create Karne Ke Liye Kuch Fields Ko Fillup Karna Hoga. Jo Ki Kuch Is Tarah Se Hai Screenshot Me Dakhe. (1)-Series:- Series Ka Matlab Hota Hai Ki Aapko Apna Data Kaha Par Rakhna Hai. Series Wo Hoti Hai Jaha Hum Apne Work ko Save Karke Rakhte Hai, Yaha Par Hum Apna Data Main Series Me Store Karke Rakhege.

(1)-Series:- Series Ka Matlab Hota Hai Ki Aapko Apna Data Kaha Par Rakhna Hai. Series Wo Hoti Hai Jaha Hum Apne Work ko Save Karke Rakhte Hai, Yaha Par Hum Apna Data Main Series Me Store Karke Rakhege.

(2)- Date:- Jis Bhi Date Ko Goods(Maal) Sale Kiya Hai, Us Din Ki Date Ko fill Karege.

(3)-Vch No:- Aapke Aur Supplier Ke Beech Me Jo Bhi Transaction Hoti Hai, Uska Proof Hi Voucher No Kahlata Hai.Voucher No Bill Me dalana Bahut Hi Important Hota Hai.

(4)-Sale Type:- Sale Type Me Aapko Kai Types Ki Tax Category Milegi, Jaise Ki Aap Apne State Me Sale Kar Rahe Hai, Ya Phir Interstate Matlab State Ke Bahar Sale Kar Rahe Hai. Busy Me Automatic Tax Category Ke Sath Aapko Local Aur Interstate Sale Ka Options Bhi Milega, Jis Se Hamko Busy Me Entry Post Karne Me kafi Aasani Hogi Toh, Aaiye Jante Hai.

Local GST Tax Rates:-

- L/GST-12% :- L Means Local GST 12% Items

- L/GST-18% :- L Means Local GST 18% Items

- L/GST-28% :- L Means Local GST 28% Items

- L/GST-5% :- L Means Local GST 5% Items

- L/GST- Exempt:– Local Gst With Nill Rate

- L/GST- Itemwise:– Local Gst With Tax Calculated In Item Wise

- L/GST- Multirate:– Local Gst With Tax Calculated In Multirate

Interstate(State Ke Bahar) GST Tax Rates:-

- I/GST-12% :– I Means Interstate GST 12% Items

- I/GST-12% :– I Means Interstate GST 12% Items

- I/GST-12% :– I Means Interstate GST 12% Items

- I/GST-12% :– I Means Interstate GST 12% Items

- I/GST- Exempt:– Interstate GST With Nill Rate

- I/GST- Itemwise:– Interstate Gst With Tax Calculated In Item Wise

- I/GST- Multirate:– Interstate Gst With Tax Calculated In Multirate Means Ek Hi Invoice Me Kai Type Ke Tax Ko Aasani Se Calculate Kar Sakte Hai

(5)-Party:- Goods Jisko Bhi Sale Kar Rahe Hai Kisi party Ya Phir Kisi Customers Ko Uska Ledger Aapko Create Karna Hoga. Busy Me New Party Create Karne Ke Liye Apne Keyboard Se (F3), KeyPress Kare.

Aaiye Ek Party Create Karte Hai. Keyboard Se F3 Botton Press Kare. Aur Kuch Required Fields ko Fillup Kare, Jaise Ki Screenshot Me Show Kiya Gaya Hai.

- Name:- Aapko Us Party Ka Pura Name Fillup karna Hoga.

- Print Name:- Bill Me Aap Kya Print Karvana Chahate Hai, Wo Name Fill Kare.

- Group:- Party Jo Create Kar Rahe Hai, Usko Ek Particular Group Me Rakhna Hoga, Jaise Ki Sale Bill Create Kar Rahe Hai Toh Aap To Party Ko Sundry Debtors Ke Group Me Rakhege.Kyuki Har Ek Group Ka Alag Nature Define Kiya Gaya Hai, Busy Accounting Software Me.

- Address:- Aapko Us Party Ka Pura Address Fillup karna Hoga.

- Country:- Aapko Country Select Karni Hogi Ki Aapki Party Kis Country Se Belong Karti Hai.

- State:- Aapko us Party Ka State Select karna Hoga Ki Aapki Party Kis State Ki Hai.

- Type Of Dealer:- Aapko Ye Select Karna Hoga Ki Wo party Registered Hai Ya Unregistered.Agar Party Registered Hogi, Toh Uska GSTIN No Hoga, Aur Agar Unregistered Hogi Toh Uska GSTIN No Nahi Hoga.

- GSTIN/UIN:- Aapko Us Party Ka GSTIN No Fill Up Karna Padega Agar Party Registered Hai To, Agar Party Unregistered Hai To GSTIN No Fill Up Karne Ki Jarurat Nahi Hai.

- Aadhar Card:- Agar Party Ka Aadhar Card Ho To Aadahar No Bhi Fill Up Kar Sakte Hai.

- IT PAN:- Party Ka IT Pan Card No Fillup Karna Hoga, Agar Party Ke Pas IT PAN No Ho To Warna Koi Jaruri Nahi Hai.Aapki jaisi Requirement Ho Aap Waisa kar Sakte Hai.

- Email Address:- Party Ka Email Address Fillup kare.

- Mobile:- Party ka Mobile No Fill Up Kare.

- Pin Code:- Party ka Area Ka Pin Code Fill Kare.

Sari Details fill Karne Ke Baad Save Ke Option Par Click Kare Aapki Party Successfully Create Ho Chuki Hai.

(6)-Mat Center:- Aapko Apna (Maal/ Goods) Kaha Par Rakhna Hai Means Ki Kis Location Par Aap Apne Maal Ko Rakhna Chahte Hai. Aap Apne Goods Ko Mat Store Me Rakh Sakte Hai Busy Ke According.

(7)-Narration:- Aap Agar Bill Me Koi Important Details Ko Addup karna Chahe To Aap Apni Marji Ke According Koi Narration Fillup Kar Sakte Hai. Narration Ko Fill Karne Se Aapko Ye Yaad rahega Future Me Ki ,Is Bill Me ,ye Amount ,Is Date Ko, Is party Ko Sale Kiya Tha.Future Me Chijo Ko Yaad Rakhne Ke Liye Hum Narration Likhte Hai.

(8)-Items:- Aapko Ab Kis Items Ko Sale karna Hai, Us Item Ko Create Karna Hoga, Yaha Maine Computer Aur Mobile (2 Items) Create Kiye Hai.

Busy Me Item Ko Create karne Ke Liye Apne Keyboard Se (F3) Botton Press karege.

- Name:- Aapko Jo Bhi Item Create karna Ho, Uska Pura Name Fillup kare.

- Print Name:- Aap Apne Bill Me Aap Kya Print Karana Chahate Hai, Wo Name Ko Fillup Kare.

- Group:- Group Me Aap Isko Kis Group Me Rakhna Chahate Hai Wo Select Kare Firhal Busy Me Hum General Group Me Items Ko Rakhege.

- Unit:- Aapka Item Kis Unit Me Hai Us unit Me Us Item Ko Rakhege Yaha Par Item Ki Unit PCS Me Hai To Hum Pcs Ko Select kar Lege.

- Tax Category:- Item Par Kaun Sa Tax Lagega Wo Tax Category Ko Select Karege.Har Item par Tax Rate Different Hota hai, To Aapka Item Kis Tax Rate Se Belong karta Hai Usko Select kare.

- HSN/SAC:- Us Item Ka HSN Code Kya Hai Use Fillup Kare. Har Ek Item Ka HSN Code Hota Hai, Aur Agar Aap Service Provide Kar Rahe Hai To SAC Code Fill karte Hai.

- Sale Price:- Us Items Ka Sale price Kya Hai, Us Price Ko Fillup Kare, Jis price Me Aap Us item Ko Sale Karna Chahte Hai.

- Pur Price:- Us Item Ka Purchase Price Kya Hai, Means Jaha Se Humne Woh Item Purchase Kiya Tha Kisi Company Ya Firm Se Wo Price ko Yaha Par Fillup Kare.

- MRP:- Item Ka MRP Rate Kya Hai Usko Fillup Kare.

Sari Details Fillup Karne Ke Baad Save Ke Option Par Click Kare. Aapka Item Successfully Create Ho Chuka Hai.

(9)- Items Ko Create Kar Lene Ke Baad Uski Entry Karege, Ki Us Item Ki Quantity Kya Hai, Price Kya Hai Etc Etc.Yaha Humne 2 Items Ko Create Kiya Hai, Ek Computer Aur Dusara Mobile.

Items Ki Sari Details Ko Fillup Karne Ke Baad Niche Aapko Apply Tax Ka Option Show Hoga, Aapko Simply Us Par Click Karna Hai, Jaise Hi Aap Apply Tax Ke Option Par Click Karege To Items Par Tax Automatic Calculate Ho Jaega Aur Niche Bill Me Aapko Taxable Amount Show Hoga.

(10)- Bill Me Sari Details ko Fillup Karne Ke Baad Aap Simply Bill Ko Save Kar Lege.Ab Aapne Successfully GST Bill Create Karna Seekh Liya Hai.

Busy Me Bill Ko Print Kaise Kare??

Busy Me Bill Ko Create karne Ke Baad Aap Usko Direct Bhi Print Kar Sakte Hai Ya Phir Jab Aap Bill Ko Save karte Hai To Busy Aapse Bill Ko Print Karna Chahte Hai, Puchta Hai.Aap Us Option Se Bhi Apne Bill Ko Print Kar Sakte Hai.

Bill Ko Print Karne Ke Liye Aapko Aapki Screen Par Aisa Option Show Hoga Bus Apko Kuch Fields Ko Fillup Karna Hoga.

- Format Of Invoice Printing:- Yaha Aapko Standard Option Ko Select Karna Hoga.

- No Of Copies:- Aapko Bill Ki Kitni Copies Chahiye, Wo Select Kare, Firhall To GST me 3 Copies Bill Allow Hai Nekalna.

Ab Sari Details Fill Karne Ke Baad Simply Print Ke Option Par Click Kare.Aapko Bill Print Ho Jaega.Print Karne Ke Liye Aap Keyboard Se Shortcut Key Bhi Use Kar Apne Bill Ko Aasani Se Print kar Sakte Hai.

Print Ke Options Par Click Karne Ke Baad Aapka Bill Print Ho Jaega.

Is Tarah Busy Me Aap Apne Bill Ko Aasani Se Create Kar Sakte Hai.

Some Shortcut Keys In Busy:-

- (F2) Bill Ko Save Karne Ke Liye

- (F3) Party Create Karne Ke Liye

- (F3) Items Create Karne Ke Liye

- (F9) Party/Item Ko Hatane Ke Liye

- (Alt+M) Data Ko Modify Karne Ke Liye

- (Alt+P) Bill Ko Print Karne Ke Liye

- (Alt+R) Refresh Karne Ke Liye

- (Alt+E) Data Ko Export Karne Ke Liye

- (Alt+D) Voucher Ko Delete Karne Ke Liye

- (Alt+L) Ledger Create Karne Ke Liye

- (Ctrl+Alt+A) Administration Menu Par Jane Ke Liye

- (Ctrl+Alt+T) Transactions Menu Par Jane Ke Liye

- (Ctrl+Alt+D) Display Menu Par Jane Ke Liye

- (Ctrl+Alt+P) Print Email Menu Par Jane Ke Liye

Play The Tally Quiz and Check Your Tally knowledge?

Start Quiz

GST Sale Bill Utility Free Download

GST Sale Bill Utility Ek GST Bill Create Karne Ke Liye Utility Hai, Jiski Help Se Aap Apna Invoice Aasani Se Create Kar Sakte Hai, Bina Kisi Software Ka Use Karke. Bus Aapko Is GST Sale Utility Me Apni Firm/Company/Shop Ki Kuch Details Ko Fillup Karna Hai

Like- Name, Address, GSTIN No, Tax Percentage And Items Etc. In Sabhi Chijo Ko Add up Karne Ke Baad Aap Is GST Sale Utility Se Aasani Se GST Ka Invoice Create Kar Sakte Hai. GST Sale Bill Utility Ko Download Karne Ke Liye Simply Niche Diye Button Par Click Kare.

- Busy Accounting Software में कैसे काम करे

- Busy Notes in Hindi Pdf Download

- Tally Notes in Hindi Pdf Download

- Accounting Book in Hindi PDF Download

- GST Hindi Book PDF Free Download

- Tally Course Syllabus Pdf

- Tally Voucher Entry in Hindi Pdf

About The Post:-

Aaj Maine Aapko Ye Bataya Ki Busy में जीएसटी बिल कैसे बनाये? Busy Software मे GST Bill Ko Kis Tarah Se Print Kare? GST Bill Creation की पूरी जानकारी हिन्दी मे जाने

अगर आपको कोई भी Problem हो तो आप मुझे मेल कर सकते है। मैं जल्दी ही आपकी परेशानी को दूर करने की पूरी कोशिश करुगा।

मैं उम्मीद करता हु की ये आर्टिक्ल आपको पसंद आया होगा, अगर आपको ये आर्टिक्ल पसंद आया तो इसको सोश्ल मीडिया पर अपने दोस्तो के साथ जरूर से शेयर कीजिए, जिस से उनको भी ये जानकारी प्राप्त हो सके।

SIR VERY GOOD USEFUL INFORMATION D HAI AAPNE

धन्यवाद

sir gst kaise dekhege busy me ye bta sakte ho aap

kuch hi din me aapko ispar article mil jaega…thanks for visit

सरजी मुझे भी कंप्यूटर से सम्बंधित बिल वूक बननजी हे आप यदि मेरी आवश्यकता दके अनुसार फाइल बनाकर सेंड कर सकते हे तो मुझे 9587466540 पर सम्पर्क करे या आपका सम्पर्क नंबर मुझे प्रदान करे

किस तरह की बिल बुक bro

Bohot aacha lga site pr aake