Hii Friends Aaj Ke Is Article Me Mai Aapko Tally Me Voucher Entry Kaise Kare? Voucher Entry Se Related Sabhi Jankari Duga, Aur Sath Hi Sath Aapko Ye Bhi Batauga Ki Aap Is Voucher Entry Ki File Ko PDF Me Kaise Download Kar Sakte Hai. Tally Voucher Entry in Hindi Pdf कैसे डाउनलोड करे? tally voucher entry questions kya hai? Voucher Entry Karne Se Pahle Aapko Tally Me Gst Kaise Enable Kare Wo Janana Hoga To Aaiye Janate hai.

Tally Me Joh Bhi Vouchers Hai Like- Contra Voucher, Payment Voucher, Sale And Purchase voucher In Sabme Hum Kis Tarah Se Entry Ko Post Kar Sakte Hai, Aaj Ka Ye Topic Is Par Hai Toh Aaiye Dakhte Hai.

Tally Me Voucher Entry Kaise Kare Hindi 2023

Tally Me Voucher Entry Karne Ke Liye Sabse Pahle Aapko Tally ERP 9 Software Me Kis Tarah GST ko Enable Karte Hai, Kis Tarah Se Company Me GST Number Aur Details Wagra ko Fillup Karte Hai? Uske bare Me Janana Jaruri Hai.To Aaiye Aapko Sari jankari Step By Step Deta Hu.

Tally Me Gst Entry Karne Ke Liye Kuch Simple Steps Ko Follow Kare.

STEP:-1 Sabse Pahle Aap Tally ERP 9 Software Ko Open Karege.

STEP:-2 Tally ERP 9 Software Ko Open Karne Ke Baad Aapko Aapki Screen Par Kuch Aisa Show Hoga, Aapko Simple Work in Education Mode Me Tally Software Ko Open Karna Hai.

STEP:-3 Ab Aap Ek Company Create Kar Le Aur Us Company Ko Open Kare.Company Ko Open Karne Pa Aapko Gateway Of Tally Show Hoga. Company Create Karne Ke Liye Is Post Ko Read Kare.

Read It:– Tally Me Company Kaise Banaye?

Tally Me GST Ko Kaise Enable Kare? How to enable GST in Tally?

Tally Me GST Ki Entry karne Ke Liye Aapko Sabse pahle Tally Me GST Ko Enable Karna Hoga, Apni Sari Details GST Ki Like- GSTIN Number, Dealar Wagara Sari Details Ko Fill Up karna Hoga Tabhi Aap Tally Me GST ki Entry Ko kar Sakege.

Aaiye Jante Hai Tally Me GST Ko Kaise Enable Kare, Uske Liye Aap Kuch Simple Step Follow karne Padege.

STEP:1- Tally Me GST Ko Enable Karne Ke Liye Sabse Pahle Gateway Of Tally Me Aapko Niche Right Side Me Features Ka Option Dikhai Dega, Aapko Us Features Ke Option Par Click Karna Hai. Ya Phir Aap Apne Keyboard Se (F11) Press Kare Features Option Open Ho Jaega.

STEP:2- Ab Aapko Statutory And Taxation Me Jakar Click Karna Hai.

STEP:3- Statutory and Taxation Me Aapko Enable Goods And Service Tax(GST) Ko Aapko Yes Karna Hai, Aur Set/Alter GST Details Ko Bhi Yes Karna Hai.

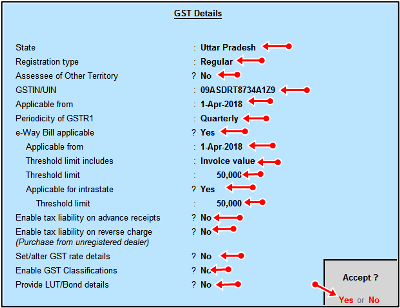

STEP:4- Set/Alter GST Details Ko Yes karne par Aapko Kuch GST Details Ko Fillup karna Hai. Aaiye Jante Hai.

- State:- Aap Kis State Se Belong karte Hai Usko Select kare.

- Registration Type:- Registration Type Me Aap Kis Type Ke Delar hai, Regular Ya Composition Usko Select Kare.

- Accessed Of Other Territory:- Yaha Aapko No Hi Rakhna Hai.

- GSTIN/UIN:- Yaha Aapko Apni Company/ Firm ka GSTIN No Ko Fill karna Hai.

- Applicable From:- Jis Bhi Date Se Applicable Hai, Wo Date Fillup Kare.

- Periodicity Of GSTR-1:- Aap GSTR 1 Kab Filing Karte Hai, Monthly ya Quarterly Use Select Kare.

- e-way Bill Applicable:- Kya Aap E way Bill Ko Generate Karna Chahte Hai, To Yes kare.

- Applicable From- Jab Se EWay Bill Applicable Hua Hai, Wo Date Fill Kare.

- Threshold Limit Includes:- Isme Aapko Invoice Value Ko Hi Rahne Dena Hai.

- Threshold Limit:- Isme Aap E way Bill ki Kya Limit hai, Jo Ki 50000 Hai use Hi Rakhe.

- Applicable For Interstate:- Isme Aap Agar Interstate Dealer hai To Yes Kare.

- Threshold Limit:- Threshold Limit Jo Bhi Ho Usko Set Kare.

- Enable Tax Liability Of Advance Receipt:- Is Option Ko No hi Rakhe Kyuki Ye tab Yes Karege Jab Tax Liability of Advance Receipt Hogi.

- Enable Tax Liability Of Reverse Charge:- Isko No Hi rakhe Because of Reverse Charge Ke Liye Aap Applicable Ho To Hi Yes kare.

- Set/Alter GST Rate Details:- Aap Apni Company/Firm Me GST Tax Rate Ko yaha Se Bhi Set kar Sakte Hai, But jab Aap Ek Hi Tax Rate Ki Item Ka Business kar rahe Ho Toh Isko Yes kare Warna No Hi Rakhe.

- Enable GST Classification: Is Option Ko Firhaal No Hi Rakhe.

- Provide LUT Bond Details:- Isko Aap No Hi rakhe.

Sari Details Ko Fillup Karne Ke Baad Aap isko Save Kar Le.

STEP:5- Sari GST Details Ko Fillup karne Ke Baad Simple Aapko Save Kar Lena Hai.

Ab Aapki Company Me Successfully GST Enable Ho Chuka Hai. Ab Aap GST Me Entry Ko Aasani Se Post Kar Sakte Hai

Tally Voucher Entry in Hindi Pdf Download Karne Ke Liye Niche Link Par Click Kare?

Read It:-

- Tally Me GST Bill Kaise Banaye?

- Tally Me Purchase Entry Kaise Kare?

- Tally Me Ledger Kya Hai? Tally Me Ledger Banane Ka Tarika

- Tally में Projects कैसे बनाये? Solve Tally Projects

- Computer में बिल कैसे बनाये? Computer billing System

- MS Excel me Gst bill kaise banaye in Hindi

About The Post:-

Aaj Ki Is Post Me Maine Aapko Ye Bataya Ki Aap Kis Tarah Se Tally ERP 9 Me Voucher Entries Ko Kaise Kar Sakte HaiTally Voucher Entry in Hindi Pdf कैसे डाउनलोड करे?.

I Hope you Like This Post. Agar Aapko GST Me Bill Creation Me Koi Bhi Problem Ho To Aap Mujhe Mail Kar Sakte Hai, Mai Jaldi Hi Aapki Problem Solve Karne Ki Puri Kosis karuga. Tally, Busy Accounting Any Software Me agar Aapko Kisi Bhi Topic Me Problem Ho To Aap Mujhe Contact Kar Sakte Hai.