Aaj Bahut Se Log Aise Hi Jinko Tally Me Entry Karna Nahi Aata Hai, Aaj Un Sab Logo Ke Liye Mera Ye Article Hai, Ki Tally Me Entry Kaise Kare? Tally Ki Valuation Tab Se Badh Gayi Jab Se GST India Me Aaya, Kya Aap Kisi Party Se Credit Par Koi Goods Purchase Karte Hai, Agar Aap Goods Ko Purchase Karte Hai To Samne Wali Party Se Jo Purchase ka Bill Aapko Received Hota Hai Jisme Kitni Quantity Aapne Goods Purchase Kiya, Uski Taxable Value Kya Hai, Us Item par Kitne Percent ka Tax Laga Ye sari Details us Purchase Bill Me Rahati Hai. Aaj Mai Aapko Tally Me Purchase Entry कैसे करे?

Purchase entry with GST Uske Bare Me Puri jankari Duga. Kyuki Purchase Bill Ki Entry Tally Me jab Tak Aap Nahi karege, GST Me Aapko ITC Nahi Milegi.

ITC Ko Lene Ke Liye Hum Purchase Bill Ki Entry Karte Hai, Kyuki Humne Jo Purchase Karte Waqt Jo Tax Government Ko Diya Hai, Uski ITC To Hamko Milni Hi Chahiye. Baad Me Hum Jab Bhi Sale karege To Us Sale Me Hamari ITC Adjust Ho jaegi, Aur Jo Bhi Tax Hamne Customers Se Received Kiya Hai. Us Tax Ki Return Hum Fill Karege.

Purchase Voucher आखिर क्या है? आइये जाने

जब भी आप किसी तरह की खरीदारी करते है तो टैली में उसकी सभी Entry को हम purchase Voucher में करते है Generally Purchase हम लोग उधारी में करते है यही की Credit में करते है।

Tally हमको दोनो ही तरह की Entry करने की Facility Provide करता है ,फिर वो चाहे Cash Me Purchase हो या फिर Credit Me Purchase हो। ऐसे सभी एंट्री को हम Purchase Voucher मे करते है।

Tally Me Purchase Entry कैसे करे? Purchase Entry with GST in Hindi 2022?

Purchase Voucher: Aap jab Kisi Tarah Ki Kharedari Karte Hai Tally Me To Uski Entry purchase Voucher Me Karte Hai. Generally Purchase Hum Log Udhari Me Karte Hai, Yani Credit Me Karte Hai. Tally Hame Dono Tarah Ki Entry Karne Ki Facility Provide Karta Hai, Fir Chahe Cash Me Purchase Ho, Ya Phir Credit Me Purchase Ho.

- Tally Me GST Bill Kaise Banaye?

- Tally Me Vouchers Kya Hai?

- Tally Me Payroll Kya Hai? Jankari In Hindi

Tally Me Purchase Ki Entry Kaise Kare Uske Liye Aapko Kuch Simple Steps Ko Follow Karne Padege. Aaiye Jante Hai Kuch Simple Steps.

STEP:-1 Tally Me Purchase Ki Entry Karne Ke Liye Sabse Pahle Tally ERP 9 Software Ko Open Karege.

STEP:-2 Tally ERP 9 Software Ko Open Karne Ke Baad Aapko Aapki Screen Par Kuch Aisa Show Hoga, Aapko Simple Work in Education Mode Me Tally Software Ko Open Karna Hai.

Work In Educational Mode Tabhi Show Hoga Jab Aapne Apne Tally ERP Software Ko Activate Nahi Kiya Hoga. Agar Aapne Tally ERP 9 Software ko License PurchaseKiyaa Hoga To Educational Mode Aapki Screen Par Show Nahi Hoga

Educational Mode क्या है – Educational Mode Wo Hota Hai Jisme Hum Only Educational Purpose Se Tally Me Entry Kar Sakte Hai, Only Learning Point Of View Se. Educational Mode Me Hum Bus (1 Aur 2 Date) Ki Hi Entry Ko Post Kar Sakte Hai.

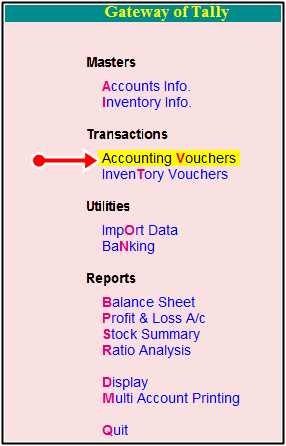

STEP:-3 Ab Aapko Gateway Of Tally Me Accounting Voucher Me Aakar Click Karna Hai.

STEP:-4 Accounting Voucher Me Click Karne Ke Baad Aapko Purchase Voucher Open Karna Hai, Purchase Voucher Open Karne Ke Liye Right Side Me Purchase(F9) Dikhai Dega Usi par Click Karna Hai,

Ya Toh Simply Apne Keyboard Me (F9) Button Ko Press Kar Dena Hai, Purchase Voucher Open Ho Jaega. Purchase Voucher Kuch Is Tarah Show Hoga.

Tally Me Purchase Bill Ki Entry Karne Ke Liye Hum Purchase Voucher Ka Use Karte Hai.

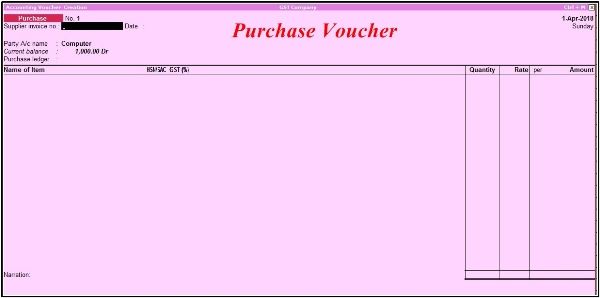

STEP:-5 Ab Hame Purchase Voucher Me Bill Ki Entry Karne Ke Liye Kuch Details Ko Step By Step Fillup Karna Hoga, Aaiye Jante Hai Ki Kaise Hum Tally Me Purchase Bill Ki Entry Karne Ke Liye Details Ko Fill Karte Hai.

Purchase Bill Ki Entry Karne Ke Liye Kuch Simple Steps Ko Follow Karne Padege.how to create purchase ledger in tally ERP 9

(1) Purchase No 1:- Ye Number Automatic Aapke Purchase Bill Me Show Hoga.

(2) Date:- Aapko Jis Bhi Date ka Bill Create Karna Ho Aap Us Date Ko Fillup Kare. But Aap Education Mode Ko Use Kar Rahe Hai, Toh Mai Bata Du Ki Aap Education Mode Me Only 1 Ya 2 Date Ki Hi Entry Ko Post Kar Paege Aur Others Dates Ki Entry Karne Ke Liye Aapko Tally Ka (Silver Ya Gold Version) Purchase Karna Padega.

Mera Tally Ka License Version Hai, Isliye Mai Yaha Par 22 Aug 2018 Tarikh Ki Entry Post Kiya Hu, Jaisa Ki Aap Screenshot Me Dakh Pa Rahe Hai.

(3) Supplier Invoice No:- Supplier Invoice No Ko Hi Hum Bill No Bhi Kahte Hai, Aapko Yaha Par Apne Supplier Ke Bill Ka No Fill Karna Hai, Jo Bill Aapko Aapke Supplier Ne Diya Hai Phir Wo Chahe Kuch Bhi Ho Sakte Hai. Example (GST/01/18-19) Log Aisa Kuch Unique Bill No Create Karte Hai.

(4) Date:- Date Me Aapko Jis Din Aapne Goods Ko Received Kiya Us Din Ki Date Ko Yaha Par Fillup Karege.

(5) Party A/c Name:- Party A/c Name Me Aapko Jis Bhi (Party/ Customer) Jis Se Goods Received Hua Hai, Uska Naam Fill Karege. Naam Fillup Karne Ke Liye Aapko Us Party Ka Ledger Create Karna Hoga. Ledgers Create Karne Ke Liye Is Post Ko Read Kare.

Tally Me Ledger Kya Hai? Tally Me Ledger Banane Ka Tarika

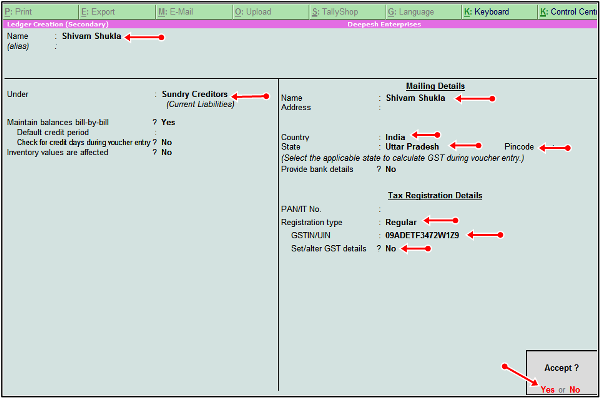

Tally Me Bill Create Karte Waqt Agar Ledger Create Karna Ho To Us Ke Liye Aapko Apne Keyboard Se (Alt+C) press Karna Hoga. Alt+C Press Karte Hi Aapko Samne Ledger Creation Ka page Open Ho Jaega. Ledger Create Karne Ke Liye Kuch Required Fields Ko fillup, Kare Jo Ki Kuch Is Tarah Se Hai.

Party का Ledger Create Karna

- Name:- Name Me Aapko Jis Bhi party Ka Ledger Create karna Hai, Uska Naam Fillup Karege.

- Under:- Us Ledger Ko Kis Group Ke Under Rakhege, Aapko Us Group Ko Select Karna Padega. Yaha Hum Sale Bill Create Kar Rahe Hai, To Jis Party Ka Ledger Create Karege Usko Hum Sundry Creditors Ke Group Me Rakhge.

- Maintain Balance Bill By Bill:- Maintain Balance Bill By Bill Ko Yes Kar Dege.

- Name:- Party ka Pura Naam Fill karege

- Address:- Party Ka Pura Address Fillup Karege.

- Country:- Country Me India Select Karege

- State:- State Me Uttar Pradesh Select Karege

- Pin Code:- party Ka Pin Code Fillup Karege

- Registration Type:- Party Ka Registration Type Select karege Ki Party Regular Hai, Ya Unregistered Hai.

- GSTIN/UIN:- Party Ka GSTIN No Fill karege Agar Party Regular Hogi.

- Set/Alter Gst Details:- Isko Hum No Rakege.

Sari Details Fillup Karne Ke Baad Simply Yes Ke Option Par Click Karke Ledger Ko Save Kar Lege.

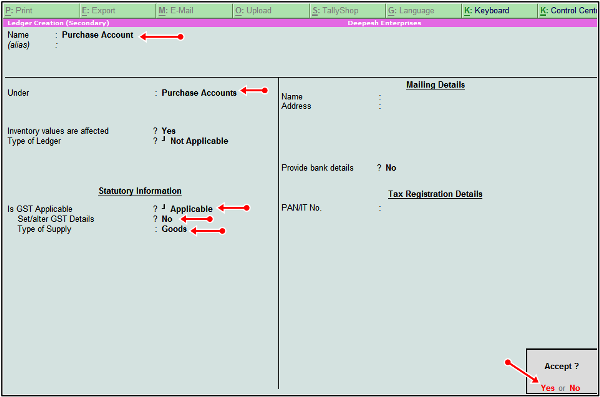

(6) Purchase Ledger:- Ab Aapko Ek Purchase ka Ledger Create Karna Hoga. AAP Is Tarah Se Purchase ka Ledger Create Kar Sakte Hai. Follow The Screenshot.

(7) Item:- Ab Aapno Jo Bhi Items Purchase Ki Hui Hai Usko, Simply Aapko Us Item Ko Create Karna Hoga. Jaisa ki Maine Apni Pichli Post Me Bataya Tha Ki Tally Me Stock Items Ko Kaise Create Kare, Aap Uske Liye Is Post Ko Read Kar Sakte Hai. Tally Me Stock Items Kaise Banaye?

Tally Me Bill Ki Entry Karte Waqt Stock Items ko Creat Karne Ke Liye Keyboard Se (ALT+C) Press Kare. Alt+C Press Karne Ke Baad Aapke Samne Stock Creation Ka Page Aa jaega. Ab Aapko Jo Bhi Stock Item Create Karni Hai,

Uski Sari Details ko Yaha Fill Up Kare. Yaha Par Maine Honda Bike Naam Ka Ek Stock Item Ko Create Kiya Hai, Aaiye Jante Hai Ki Stock Item Ko Kaise Create Kare Aur Tax Rate Kaise Setup Kare?

- Name:- Name Me Aapko Jo Bhi Stock Item Create Karna Hai Uska Pura Naam Fillup Kare.

- Under:- Under Me Isko Primary Me Hi Rakhe.

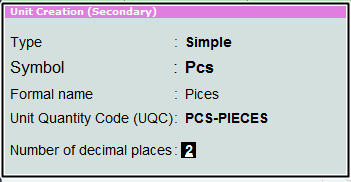

- Units:- Stock Item Ke Liye Ek Unit PCS Create Kar Le. Unit Create Karne Ke Liye Keyboard Se (Alt+C) Press Kare Aur Units Ko Create Kar Le. Kuch Is Tarah Se Jaisa Screenshot Me, Maine Ki Hai.

Unit Ko Is Tarah Se Create Kare.

- GST Applicable:- Yaha Aapko Ye Batana Hai Ki Aap GST Applicable Karna Chahate Hai Ki Nahi, Aapko Simply Applicable Option Par Click Karna Hai.

- Set/Alter GST Details:- Set/ Alter GST Details Ko Yes karna Hai, Aap Jaise Hi Isko Yes Karege Aapke Samne Aisa Page Open Hoga, Jisme Aapko Stock Item Se Related Sari Details jaise Description, HSN/SAC Code, Tax Details Aur Tax Type Ko Fillup Karna Hoga. Screenshot Me Aap Dakh Sakte Hai.

GST Details और Tax Rate को इस तरह से Setup करे

- Description:- Isme Aap Item Ki Description Ko fill Karege

- HSN/SAC:- Item ka HSN Code Fill Karege Aur Agar Service Ki Sell Kar Rahe Hai Toh SAC Code use Karege.

- Calculation Type:- Is me On Value Select Karege.

- Taxability: Isme Aap Taxable Ko Select Karege

- Tax Type: Tax Type Me Us Item par Jo Tax Rate hai Usko Fill kare Tally Automatic CGST Aur SGST Tax Calculate Kar Lega.

- Type Of Supply:- Types of Supply Me Aapko Goods Ko Select Karna Hai.

Sari Details Fillup Karne Ke Baad Simply Yes Ke Option Par Click Karke Ledger Ko Save Kar Lege.

Item Create Karne Ke Baad Aapko Us Item Ki Kitni Quantity Ko Aapne Purchase Ki Hai, Kis Rate Me Purchase Ki Hai Wo Sari Details Ko Fillup Karna Hoga.

(8) CGST:- Ab Aapko Tax Ke Ledgers Ko Create Karna Padega, Hamari Party Local Hai Isliye Hum CGST, SGST Ka Ledgers Ko Create Karege. CGST Means (Central Goods And Service Tax) Aur SGST (State Goods And Service Tax). CGST Ka Ledger Create Karne Ke Liye Screenshot Dekhe.

(9) SGST:- SGST Ka Ledger Create Karne Ke Liye Is Screenshot Ko Follow Kare. I Hope Ki Ab Aapko Ledger Create Karne Me Koi Problem Nahi Ho Rahi Hogi, Agar Aapko Ledger Create Karne Me Koi Bhi Problems Hai, Toh Aap Meri Ledger Creation Ki Post Ko Read Kar Sakte Hai.

(10) Provide GST/Eway Bill Details: Isko Aapko No Hi Karna Hai, Ye Option Ko Yes Tabhi Karege Jab Aapke Invoice Ki Value 50000 Ya 50000 Se Jada Hogi.

(11) Narration:- Future Me Aapko Yaad Na Rahe Ki Kis Bill Me Kya Entry Post Ki Hui Thi, Uske Liye Hu Ek Short Narration Likh Dete Hai, Jis Se Hamko Yaad Rahe. Jaise Maine Credit Par Shivam Se Goods Ko Purchase Kiya To Mai Ek Short Narration Likh Duga Ki- Being Goods Purchase On Credit As Per Bill No GST/01/18-19

Bill Me Sari Details Ko Fillup Karne Ke Baad Yes Ke Option Par Click Karke Bill Ko Hum Save Kar Lege. Aab Aapne Purchase Bill Ki Entry Successfully Karni Seekh Li Hai.

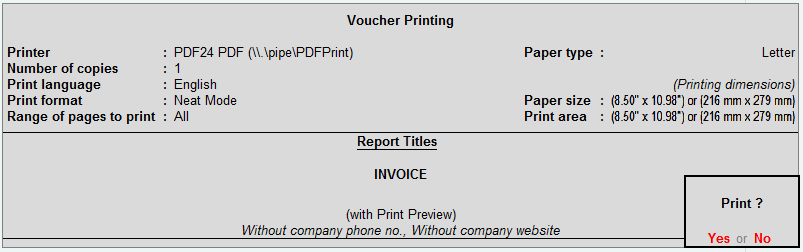

Tally ERP 9 मे Purchase Bill को कैसे Print करे, आइये जाने?

Tally Me Bill Create kar Lene Ke Baad Aapko Agar Apne Bill Ko Print Karna hai,Toh Uske Liye Aap Upar (Print P) Ke Option Par Jakar Click kar Sakte Hai, Ya Phir Aap Apne Keyboard Se (Alt+P) Botton Ko Press karna Hoga. Alt+D Press karne Ke Baad Aapke Samne Aisi Window Appear Hogi. Aapko Bus Simply Yes Ke Option Par Click karna Hai.

Jaise Hi Aap Yes Ke Option par Click karege Aapka Purchase Ka Bill Print Ho jaega, Aap Isko Directly Print Nekal Sakte Hai, Ya Phir Aap Is Purchase Bill Ko PDF Format Me Save kar Sakte Hai.

Toh Is Tarah Aaj Humne Ye Seekha Ki Tally Me Purchase Bill Ki Entry Kaise kare.Banana. I Hope Ki Aap Bhi Purchase Ki Entry Aasani Se tally Me Kar Sakege.

Technical Cube Tally Hindi Notes free Download

Tally Hindi Notes को Buy कैसे करे ??

Debit/ Credit Rules के बारे मे जाने:-

Tally Me Aksar hame Debit And credit Me Hamesa Confusion Create Hoti Hai, Ki Kise Debit Kare Aur Kise Credit Isliye mai Aapko Kuch Rules Bata Raha Hu jiski Help Se Aap Aasani Se debit Aur credit Kar Sakege. Toh Aaite Jante Hai.

Debit Rule:-

- Jis Ko Paisa Milta Hai, Woh Hamesa Debit Hoga.

- Hamare sare Kharche Means Expenses Debit Hoge.

- Jo Vastu Business Me Aaegi, Wo Debit Hogi.

Credit Rule:-

- Jiske Pas Se Paisa Jaega, woh Hamesa Credit Hoga.

- Hamari Sari Incomes Credit Hogi.

- Jo Vastu Business Se jaegi Usko Hamesa Credit Karege.

Tally Hindi Notes Ko Download Karne Ke Liye Niche Link Par Click Kare

- Hindi Typing Book PDF Download-Sneh Hindi Book

- DCA Course Book Hindi Pdf Free Download

- CCC Previous Paper PDF Download 2020

- Tally Course Syllabus Pdf

- Tally Voucher Entry in Hindi Pdf

पोस्ट से संबन्धित सारांश:-

आज मैंने आपको बताया की Tally मे Purchase Voucher क्या है? Tally Me Purchase Entry कैसे करे? Purchase Entry in Tally with GST in Hindi पूरी जानकारी आज मैंने आपको दी। मैं उम्मीद करता हु की आपको ये आर्टिक्ल पसंद आया होगा।

अगर आपको ये आर्टिक्ल पसंद आया हो तो इसको सोश्ल मीडिया पर अपने दोस्तो के साथ जरूर से शेयर कीजिए, जिस से उनको भी ये जानकारी प्राप्त हो सके।

nice bro

Thanks manish

aapke contact no. send kro plz

Email me [email protected]

kisi exp’s ki entry purchase Voucher se krni he

jb ki vh goods nhi he exp’s he jo ki exp’s head me show hona chahiye

Thanks for giving knowledge.

Thanks

Very Good Knowledge provided by you friend. Thanks|